will child tax credit payments continue into 2022

Government disbursed more than 15 billion of monthly child tax credit payments in July to American families. That means the child tax credit returns to a 2000 lump sum for individuals making up to 200000 and couples filing jointly who make up to 400000 with 1400 refundable.

The Monthly Child Tax Credit Payments Are Done Here S What Will Replace It Fortune

Child tax credit payments have ended but stimulus checks will continue being sent into 2022 Staff Report December 20 2021 507 PM Updated.

. Lots of parents found money in their checking accounts over the last few months. 17 that it was aware of cases in. One question tens of millions of Americans are asking is whether the monthly child tax credit that was put in place during the COVID-19 pandemic rescue will be extended into 2022 as part of the bill.

The future of the monthly child tax credit is not certain in 2022. 15 Democratic leaders in Congress. The amount is up to 3000 per child for parents with dependents between the ages of six-17.

Losing it could be dire for millions of children living at or below the poverty line. Eligible families who did not receive any advance child tax credit payments can claim the full amount of the child tax credit on their 2021 federal tax return filed in 2022. Will monthly child tax credit payments continue into 2022.

Government disbursed more than 15 billion of monthly child tax credit payments in July to American families. The benefit for the 2021 year is 3000 and 3600 for children under the age of 6. That money will come at one time when 2022 taxes are filed in the spring of 2023.

Including the last half of the tax credit recipients could get a total of up to 3600 per child 5 years old and younger and 3000 for every. Therefore child tax credit payments will NOT continue in 2022. Child tax credit payments will continue to go out in 2022.

Another key deadline is coming up next week for parents eligible for the November child tax credit payment the second-to-last one of the yearThe credit is. However Congress had to vote to extend the payments past 2021. The child tax credit was expanded.

One question tens of millions of Americans are asking is whether the monthly child tax credit that was put in place during the COVID-19 pandemic rescue will be extended into 2022 as part of the bill. The monthly child tax credit payments of 500 along with. Heres what you need to know about the child tax credit as the calendar turns from 2021 to 2022 including what it will look like in the new year how it.

This credit begins to phase down to 2000 per child once. The American Rescue Plan which was signed into law on March 11 2022 expanded the Child Tax Credit which meant. Now even before those monthly child tax credit advances run out the final two payments come on Nov.

Six child tax credit payments went out in 2021 and the rest of the money will come with your tax refund this year after you file your taxes. Here is what you need to know about the future of the child tax credit in 2022. The answer at least for the time-being is yes.

Since time is running out to. Congress fails to renew the advance Child Tax Credit payments which would have been part of the Build Back Better Act and the payments expire. PARENTS who welcomed a new baby into their family still have time to claim up to 5000 on their tax refund this year.

The American Rescue. 2 days agoBidens paid 246 tax rate on 610702 earnings their tax filings show Vice President Kamala Harris and her husband Doug Emhoff earned 1655563 in 2021 and paid 523371 a federal income. That 2000 child tax credit is also due to expire after 2025.

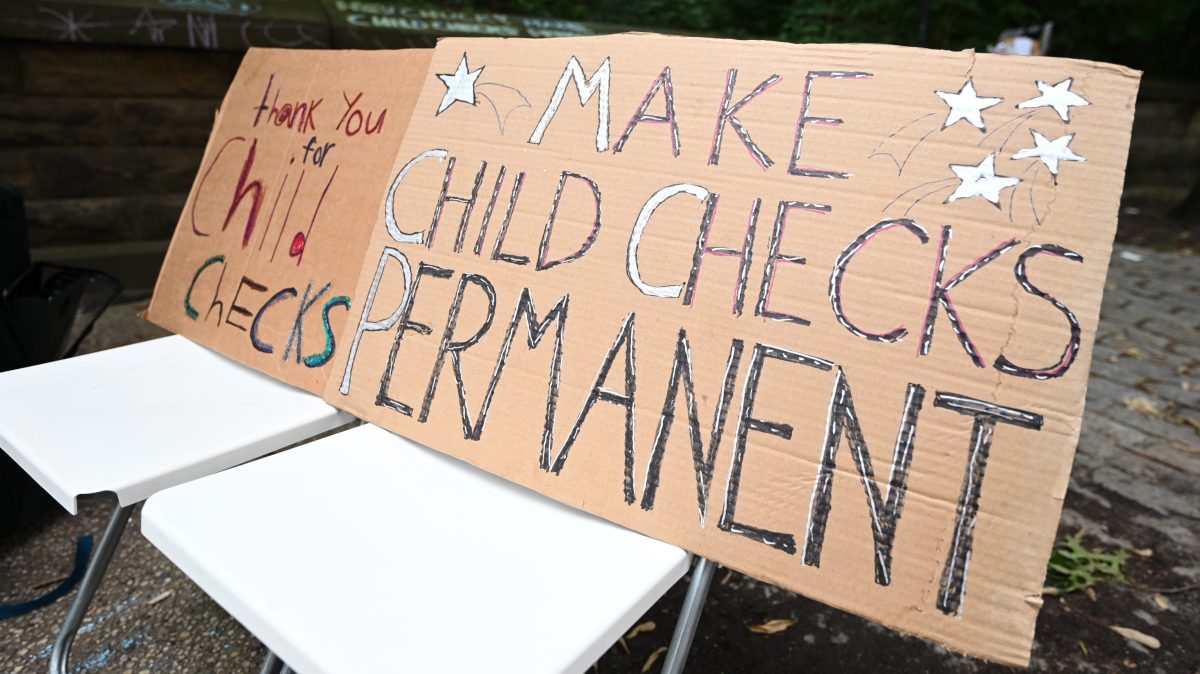

508 PM The final child tax credit payment went out to Americans was just sent last week but if anyone is still owed stimulus checks theyll see those next year. Extending it has been part of budget negotiations in. 15 Democratic leaders in Congress are working to extend the benefit into 2022.

The advance child tax credit payments are set to expire at the end of the year. Similar to the EITC the child tax credit is designed to benefit working families by allowing them to claim a credit per qualifying child.

If You Got The Child Tax Credit In 2021 You May Pay In 2022 Wsj

Child Tax Credit Ends For 36 Million Families Marketplace

Why Biden S Expanded Child Tax Credit Isn T More Popular The New York Times

Aicpa Seeks Exemption For Cpa Firms From Expected Beneficial Ownership Registry In 2021 Risk Matrix Job Interview Questions Students Tech

Non Disclosure Agreement Sample Real Estate Forms Non Disclosure Agreement Contract Template Agreement

Conventional Down Payment Grant Program Nc Mortgage Experts Determination Quotes Positive Quotes Work Quotes

City Of Henderson Seeks Emerging Local Bands To Compete In Battle Of The Bands In 2022 Local Bands City Events Battle

Child Tax Credit 2022 Are Ctc Payments Really Over Marca

Moneyvalue Creating Generational Wealth Life Insurance Quotes Term Life Insurance Quotes Wealth

Understanding And Improving Credit Scores Infographic Netcredit Blog Credit Score Infographic Improve Credit Score Credit Score

Will Child Tax Credit Payments Be Extended In 2022 Money

Irs Provides Fsa And Hsa Tax Break For 23andme As A Medical Expense Tax Pro Today Http Back Ly U2ewj Medical Estimated Tax Payments Tax Payment Nanny Tax

Will Monthly Child Tax Credit Payments Be Renewed In 2022 Kiplinger

First Month Without The Expanded Child Tax Credit Has Left Families In Distress Npr

Do You Know What Percentage Of Homeowners Have Student Debt The Answer Is 24 Have Student Loans Remaini In 2022 Budgeting Finances Student Debt Student Loan Debt

What Are You Saving And Investing So Diligently For There Has To Be A Why Passive Income Investing Spending Problem

What Is Helium Hnt And What Is It For In 2022 Wireless Internet Connection Blockchain Technology